Today’s reality of Nigerian business environment is filled with uncertainties and depreciating agility of the majority of small and medium enterprises (SME) in the country, which consequently hinder small firms to evolve and deploy viable short-term and long-term strategies towards their growth and survival.

Just reeling from the impacts of COVID-19 pandemics during 2019 and 2020, the central bank, towards the end of 2022 slammed hostile cash-crunch policy on Nigerian people and small businesses with the consequence of loss of lives of small businesses and people at the bottom of economic pyramid. As if the two economic calamities are not sufficient, the newly elected federal government came out with a sudden and immature announcement of departure of fuel subsidy which finally buried the remaining lives of the small and medium businesses in the country.

The questions provoking many thoughts are; i) how would the Nigerian SMEs grow profitably and survive in the hostile market environment of the country? ii) do the firms with small economies of scale and scope have the capabilities and resources to map out strategies that will insure them against these odds? iii) what are the key strategies they should evolve and deploy on a short and long range to survive?

Responding to the questions, four strategies are key to the growth and survival of Nigerian SMEs in the prevailing hostile and munificent environment, and these are identified and explained below. The strategies are further corroborated with a SME life cycle curve and market opportunity-environment dynamism matrix that are typical to the operations and environment of small and medium enterprises in the Nigeria as a developing nation.

Market-Entry Strategy

One of the most difficult decisions for SME to make within its internal and external environment is how to decipher market dynamics, competition and disruption in products, processes and technology. Hence, the need for a formidable market-entry strategy on what market small/medium firms are entering or what new products are they offering.

In Nigerian formal and informal markets where uncultivated opportunities are abound and where cognitive abilities of most entrepreneurs enable them to make strategic choices of creating new products or markets that have not been exploited previously by others, or by expanding existing markets or products, small/medium firm that intends to enter a new market or trying to introduce a new product in an existing market, would undoubtedly face series of entry barriers such as price war, rivalry, dominant behaviours of existing firms, unfriendly government policies/regulations, and weak support institutions.

Therefore, it is expected of small/medium firms, to evolve and deploy market-entry strategy that is able to explore and exploit critical resources, opportunities and capabilities available within and outside of the firms, and consider barriers like market switching costs, and inconsistent government policies. The strategy should also cover the firms’ perception of risk-reward assessment and alignment, internal resource constraints (include capital requirements) and the leadership styles of the owners of small firms.

Pricing Strategy

Price competition among firms can be very intense and disruptive. Hence, SME should take strategic decision-making on its product prices very seriously to avoid under-pricing or over-pricing of its products/services. Attractiveness of customers to firm’s products or services come from the customers’ perception of ‘value’ which is also firmly accosted by the ‘offer price’ of such products/services.

Small/medium firm’s ability to compete in product pricing will largely be driven by good strategy that contain cost structure, competitors’ pricing strategies, channel/customer pricing dynamics, and consumer value perception. So also important is the information asymmetry regarding the changing nature of the market, industry, competitors and the customers, for the fact that the dichotomy of information available to individuals managing small/medium firms and the business owners dictate the probability and the extent to which firms’ pricing strategy could be achieved.

Moreover, product pricing is a powerful lever of profitability and growth, particularly for the SME businesses. Therefore, a good pricing strategy should enable small firms capture actual and potential ‘value’ through the elements of the marketing mix, and also enable alignment of the mix towards a common goal of competitiveness, profitability and survival.

Financing Strategy

The most painful headache for small /medium firms in the quest for growth and survival is the inability of the firms to adequately and promptly source for funds to finance entry into new market/products, innovation, growth and survival. Moreover, capital structure optimisation, high cost of funds, mandatory loan security, indifference of private and institutional investors, are peculiar finance issues to the growth and survival of SMEs in Nigeria.

The fact that financing strategy is also a dominant and survival strategy, means that SMEs should develop varieties of forward-looking strategies that embed financial discipline, optimal debt-equity structure, potential financial distress assessment, actual and opportunity cost of obtaining funds, retained earnings policy, funds re-investment policy, risk and reward of formal and informal sourcing of capital, etc., in order to create or add value to the business. Situations of high/low profitability cum low/high cash holding are also important in financing either the fixed or working capital investment.

Compliance Strategy

Compliance with the regulatory and policy environment is usually out of key strategies that small/medium enterprises evolve and deploy. This might likely be, because of lack of advisory and consulting from professionals, political affiliation power of business owners, habits of cutting corners and simple ignorance.

SMEs should have strategies that are directed towards compliance with personal and company taxes, regulations from government and quasi-government authorities, traditions and culture of informal markets and allied trade associations, particularly those of the immediate community of the firm. Strong compliance strategy of small/medium firms should encompass good corporate governance and risk management and controls of the firm’s competitive environment.

Market Entry-Survival-Maturity Curve for SME in Nigeria

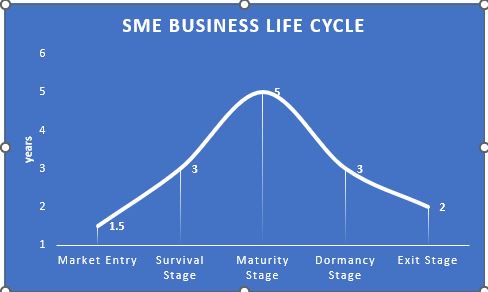

The understanding of key strategies for SMEs’ survival in a competitive market like Nigeria is incomplete without explaining business life cycle peculiar to small/medium firms in the country being a developing economy. Please refer to figure 1 below.

Figure 1: Business life cycle for typical SME in Nigeria

In Nigeria, it does not take a long time for newly registered and well-funded SMEs to enter market after necessary registration compliance. However, it takes up to 3 years on the average for small firms to get onto the survival mode, depending on the nature of business and prevalent market dynamics such as rivalry, competitive intensity, environmental conditions, government monetary and fiscal policies, etc. Moving from survival stage to maturity stage can either be longer or shorter than expected because it is largely dependent on constantly changing technology disruption globally and its impacts on consumers’ preferences, choices and perceptions. It is how the maturing stage of the firm is handled by the business owners/managers that determines the dormancy or exit stage of the firm. The stages of maturity and exit for SMEs in Nigeria can sometimes be simultaneous and mutually exclusive. With no strong entry and exit strategies, an average SME in Nigeria may not live more than 5 years of business life.

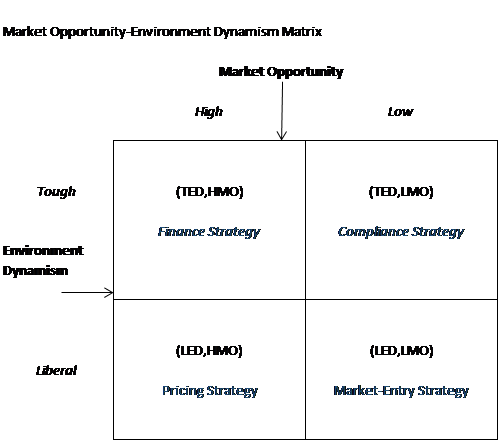

Market Opportunity-Environment Dynamism Matrix for SME in Nigeria

A 2×2 matrix (figure 2) is modelled for assessing and deploying the 4 key strategies when SMEs are seeking for market opportunities in terms of profit margin and growth in the ever changing political, economic, social, technological and legal environment of Nigerian market.

Figure 2 : Market Opportunity-Environment Dynamism Matrix

The matrix which builds market opportunity on its columns (y axis) and environment dynamism on its rows (x axis) are both put on a high and low scale. The combinations of the high/low opportunity and dynamism would result in the possible strategy that the firm would evolve and deploy for survival in the highly competitive business environment.

Beyond the conceptual analysis of this article which limits possible strategic choices in the matrix to the four identified individual strategies, it is possible to have a strategy mix of the four depending on an in-depth qualitative or quantitative study.

Expected performance outcomes from the strategy deployment could be (not limited to) the following:

Market-Entry Strategy: visibility, market share participation, first-level penetration

Pricing Strategy: increased revenues/sales, increased profit margin, good contribution for fixed cost absorption

Financing Strategy: Good cashflows, liquidity, solvency, optimal capital structure, serviceable indebtedness

Compliance Strategy: Break-even points on sale/profits, stakeholders’ trust and confidence